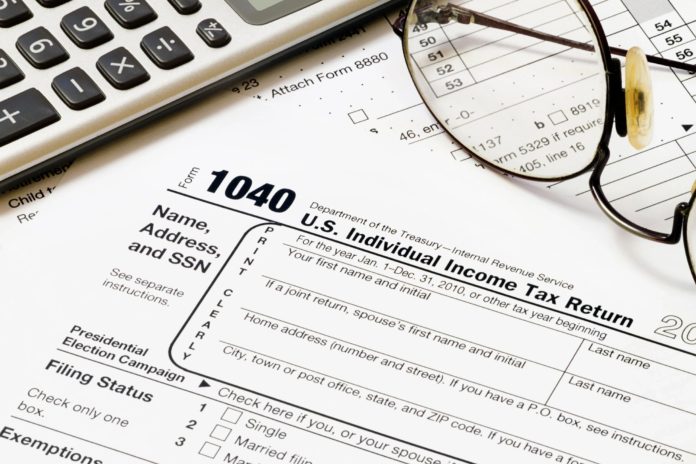

There is NO escaing the IRS, no matter how hard you try to avoid them! They’ll find you and the longer you take to settle your issues with the IRS, the longer it will take in addition to the more costly it will be for you.

AccountingToday.com suggests this is the time to handle your business and get right with the IRS; stating now is the best time to do that.

Taxpayers with unpaid taxes need a plan — and the best time to execute the plan is during tax season. Why? In order to get in good standing with the IRS for back taxes, taxpayers must be in both filing and payment compliance. For those who owe and cannot pay each year, tax filing season is the easiest time of the year to get back into both filing and payment compliance with the IRS and to get into an agreement with the IRS that will break the noncompliance cycle.

Filing compliance requires that the taxpayer has filed all required past returns. Taxpayers who are not in filing compliance cannot enter into an agreement with the IRS on their tax debts. IRS policy states that filing compliance is met if the taxpayer files a tax return for the current year and the past six years. For example, taxpayers are currently considered compliant if they have filed 2012-2017 (the past six years) and the current 2018 tax year by its due date.

For more finance-related stories on Urban Media Today, click here!