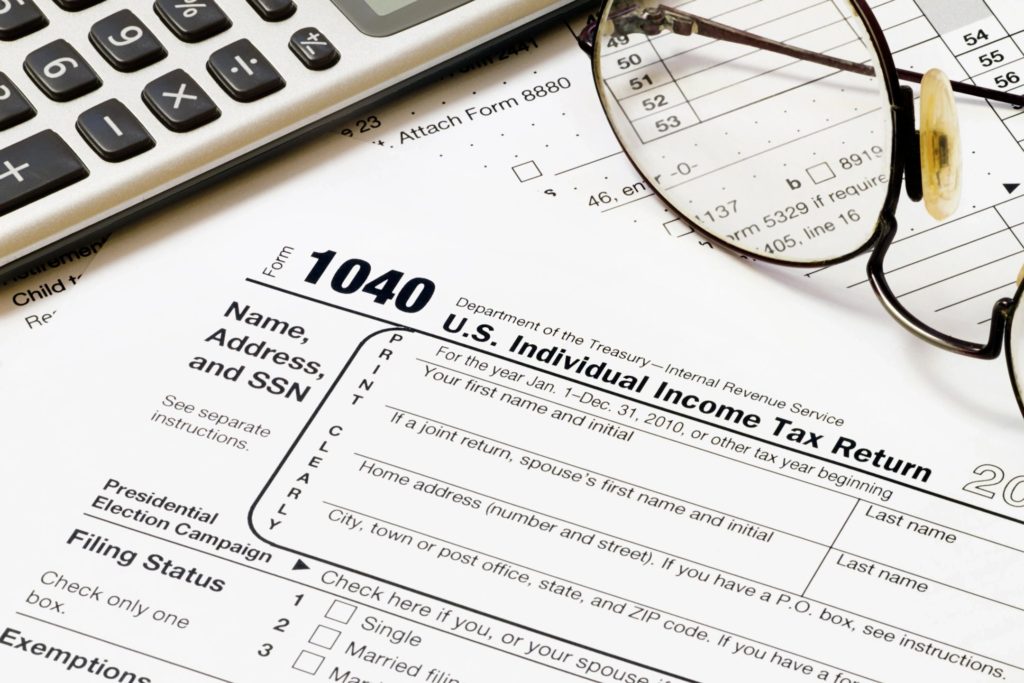

During this tax season, many Americans are preparing to file in hopes of receiving an acceptable return. With the recent changes, there are some items you can or cannot claim and it’s making a lot of families worry about what they can expect once they’ve filed.

As of 2016, the annual statistical report on social security benefits in the United States claims “10,153,205 people receiving Social Security disability benefits as disabled workers, disabled widow(er)s, or disabled adult children. The majority (86.8 percent) were disabled workers (some of whom had made claims beforehand on workers compensation due to injuries. like that discussed here: https://www.ffvamutual.com/employers/claims/), 10.7 percent were disabled adult children, and 2.6 percent were disabled widow(er)s.”

The money these people receive in the form of social security disability benefits can help them to provide a living for themselves and their families, as this money can go a long way in ensuring their financial stability. Before being eligible for these benefits though, these people would have had to provide an application to The Social Security Administration to qualify. As a result of the long and hard process that they could endure, some of them may have even enlisted the help of somewhere similar to Crest SSD to help manage their application, as well as giving them all of the help and advice they could need. Once this has been done, they will then receive their monthly social security benefit payments.

LendEDU provides important information about what is tax deductible when you’re currently receiving disability benefits.

When it comes to your earning ability, disability insurance can make a significant, positive difference in your financial picture. However, it is important to know how this type of insurance impacts your taxes, both from an insurance premium perspective and a benefits perspective.

In general, disability insurance is not tax deductible and therefore does not reduce your total taxable income when premiums are paid. However, disability insurance does have some tax benefits.

Health insurance premiums that are paid through payroll deductions are often taken out pre-tax, helping to reduce taxable income year to year. However, disability insurance premiums are paid with after-tax dollars. Business owners burdened by the responsibility of ensuring that payrolls and taxes are fully in order may benefit from utilizing a solution like Cloudpay: a global payroll platform with powerful integrations, unified workflows, and access to experts to help them with the process.

The fact that disability insurance premiums are tax-free is incredibly helpful if you need to go on claim. Disability income insurance payouts range from 50 percent to 80 percent of your income, depending on the insurance provider you select and the amount of coverage you put in place, having a look around at different insurance agencies such as Breeze Insurance and others can give you an idea of a policy that could be available to you. This is different from life insurance, for example, which pays out a lump sum death benefit in the event of the insured person’s passing.